A diocese or parish cannot successfully manage their activities without timely, accurate financial information properly represented using correct and consistent accounting principles. Anything less reduces the financial information to an electronic version of a shoebox full of receipts.

Flexible reporting

A proper accounting system for the Church is one that is designed specifically for use by churches. The resulting underlying architecture of the system is one that is designed to accurately represent church-specific transactions and activities, such as:

- Donor-designated restrictions on contributions. The Church often has donations given for specific purposes – youth mission trips, outreach, prayer intentions, columbarium support, flowers, etc. These donor-restricted contributions must be identified separately in the accounting system.

- Church-initiated restrictions on income and assets. Money that is set aside by the church for special purposes must also be identified in the accounting system separately to ensure its use for intended purposes.

Sometimes these monies are very large, and their restrictions and use span multiple years. A proper accounting system is designed to easily and accurately account for these types of transactions.

Fund accounting

Commercial accounting packages designed for business use are not sufficient; they do not use fund accounting. Fund accounting sometimes uses quadruple entry transactions rather than double, which all commercial packages use. Fund accounting gives the church a way to identify money that is set aside for specific purpose in the books of the church. It requires that revenue and expenses be recorded normally as commercial transactions; but there is also a need to identify the revenue as a donation for a specific purpose and to ensure that the money set aside is released only for an expenditure for the purpose intended. The latter are examples of when fund accounting is necessary.

Flowers illustrate how fund accounting is typically applied in the church setting. The church will budget for flowers for normal occurrences, such as Sunday Mass. The church, however, will also take donations in memory of someone, particularly for use at Easter. Further, the pastor or trustees may set aside some undesignated money for the purpose of a specific service, such as Pentecost. All three of those monies are accounted for differently, and two require fund accounting. The first example, budget, is basically commercial accounting – pay the flower bill from the general church coffers. The latter two require that the money set aside for flowers be segregated from the general money and spent only for the purpose of Easter flowers or Pentecost flowers. There is a second transaction accompanying the receipt of income that sets aside the money for Easter flowers. There is a second transaction that moves undesignated money from the general fund to the Pentecost flower fund. Neither involved real money, but they are nonetheless necessary for the segregation of money in the books of the church.

Accounting systems

If an accounting system is not designed to give users the ability to temporarily restrict funds for a specific purpose, then it is of no use to a church, which has designated money all over the place. If a bookkeeper is required to make a journal entry in the books to accomplish a normally occurring transaction, then the software is likely not the right one.

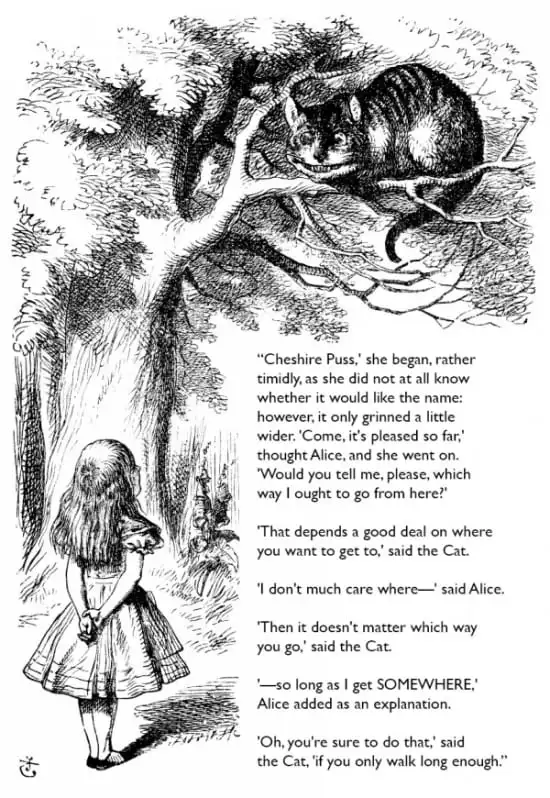

How do I decide what I need?

Know your industry (not-for-profit, religious institution) and its requirements according to accounting standards. These standards are called Generally Accepted Accounting Principles (GAAP) and are the standard for use across all businesses, including nonprofits. Churches do not have owners. There is no stock ownership. The financial statements look different from a commercial set of financial statements for a reason – donors and donations must be identified and accounted for according to GAAP. In the case of large donations intended to be used over a long period of time, there are laws in addition to GAAP that require this segregation of money and its prudent use.

Know your requirements

All assets of the church are required to be recorded in the accounting records of the church. This means all money in all accounts, regardless of source, and all fixed assets or other items of value. Just replacing existing accounting systems is not the right way to look at the issue. Do not get a general ledger package that is from one vendor and a fixed asset package from another. Get a package that is integrated with all the modules necessary to run the church from a single vendor. The requirements are explained below, but their order does not suggest importance over another. They are all equally important and must be present to select the software for use in your church.

The software must:

- Be written for the not-for-profit industry, preferably for churches, and use fund accounting principles and accounting methods in its transactions.

- Use the right nomenclature for churches in its financial statements, chart of accounts, user documentation, and training materials.

- Be robust enough to easily allow for the initial setup by church personnel (once properly trained).

- Never allow a transaction to be altered or deleted. If a transaction is entered incorrectly, another must be entered to correct it. This creates an audit trail to follow all transactions, even errors and their corrections, within the system.

- Provide user-specific access with password control at the function level. In other words, prevent the person who posts the contributions from also accessing the general ledger. Allow for an individual to print reports, but never touch the accounting transactions. Allow the rector to access the demographic data of parishioners, but not the financial giving data. All of this requires user-specific access with password control.

- Provide for the retrieval of data to produce user-specific reports in addition to GAAP statements.

- Provide for the proper accounting of unrestricted, temporarily restricted, and permanently restricted fund balances and identify if they should ever get out of balance.

- Provide for GAAP accounting transactions of all types, especially for church-specific transactions.

- Provide for cash and accrual bases of accounting separately and intermixed to create a modified cash basis of accounting.

- Contain all modules necessary to keep the financial records of the church. For example, a module for contributions including a receipts journal by donor; one for fixed assets and depreciation; one for check disbursements including a disbursements journal by payee and a check register; a general ledger including a record of all journal entries; payroll. These are not only useful, but required for internal control, audit trails, or reconciliation.

- Process transactions as they normally occur in the daily life of the church. What I mean by that is the software is so well designed that if you do not know how to process a particular transaction, it is intuitive where to start and the software follows a logical method because the software works like the church does. It may sound vague, but if you are using software that does not work like this, you know exactly to what I am referring.

- The vendor must be of sufficient size and longevity to provide proper customer service, prompt issue resolution, program fixes, clear and concise documentation, and detailed educational materials. These take money and lots of it. A small vendor has a few hundred churches using their software. A vendor of sufficient size has several thousand churches (entities, not users of which there could be multiple per church).

Summary

Churches are required to use fund accounting by nature of their industry and types of transactions. ACS OnDemand or Realm (both from ACS Technologies) were designed specifically for churches to allow the easy recording of naturally flowing transactions of the church. If your church is not using one of these, don’t walk away from what you are using – RUN!!